Introduction

The hum of digital progress is unmistakable, and no industry exemplifies this better than banking. Gone are the days of queuing up at your local branch for a simple transaction or wrestling with a checkbook to organize your finances. Today, the landscape of banking has morphed under the influence of the online world, transforming our screens into portals to digital vaults.

This shift towards online banking didn’t happen overnight, but rather, was a progression woven slowly into everyday commerce. It altered our interactions with money, throwing open the gates of convenience, and setting the pace for a financial future that exists predominantly in the vast ether of the web. But where is this journey headed? The future of online banking, sometimes painted as a dystopian interface dominated by machines and devoid of personal connection, brims with promising, dynamic potential. So, lean in and fasten your seatbelt, as we embark on this technological odyssey into the evolving realm of online banking.

Evolution of Online Banking

The journey from traditional physical transactions to modern online banking offers a comprehensive view of banking’s digital evolution.

The Origins of Online Banking

Traditional banking, known for physical transactions and long waiting lines, began to shift in the late 20th century with the growth of internet connectivity. Online banking initially was simply an addition to physical banking—banks replicated their services on an online platform. The transactions became more accessible, but they did not fundamentally change. Their aim, however, was clear—convenience—an objective that continues to shape online banking’s evolution.

A milestone in the early days of online banking was the initiative by Stanford Federal Credit Union, the first institution to provide internet banking services to all its customers in October 1994.

Maturing of Online Banking in the New Millennium

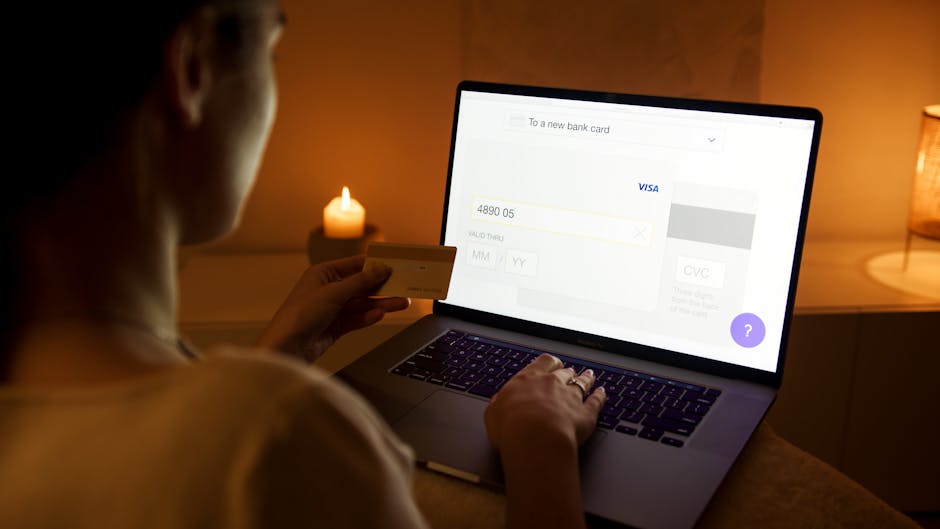

As we transitioned into the new millennium, online banking significantly transformed. With the development of enhanced internet security protocols, secure online transactions became a reality, establishing customer trust in digital banking. Furthermore, the evolution of smartphone technology and mobile apps amped up the accessibility quotient. With these advancements, consumers could conduct various transactions like bill payments, funds transfers, and even check deposits with a few taps on their screen.

Contemporary Online Banking: A Blend of A.I., Big Data, and Personalized Services

Modern online banking, with the aid of A.I., machine learning, and big data, is now able to offer personalized and intuitive services to its users. From offering unique customer experiences, personalized financial advice, and fraud detection, to budgeting tools—online banking is now far more than just a platform for transactions.

The Continuing Journey of Online Banking

Regardless of all the advancements, it’s essential to note that evolution isn’t a destination; it’s an ongoing journey. The convenience and benefits we enjoy with online banking today indicate that there are still many more milestones for us to explore and celebrate in this journey.

Current Trends in Online Banking

Let’s delve into the heart of present-day online banking, where dynamic innovations are the new norm. Today’s digital banking trends are beyond mere account balance checks and transaction history overviews; the landscape has become far more sophisticated, creating a unique, personalized experience for each user.

Firstly, the concept of mobile banking is on the rise. According to data from the World Bank, almost 70% of the world’s population owns a smartphone today, and with this massive user base, banks can reach more customers on a platform they are familiar with and comfortable using. From depositing checks with a snap of your smartphone camera to transferring money in a few taps, mobile banking has emerged as one of the leading trends in the industry.

Another significant development is AI-driven customer service, commonly in the form of smarter chatbots. These digital assistants, powered by artificial intelligence, can handle 24/7 customer inquiries and provide instant solutions. They help banks streamline service delivery, improve customer satisfaction and reduce operational costs.

Lastly, we can’t fail to mention the increasing trend of open banking. This concept is all about sharing customer banking data securely between financial institutions, under consent from customers. This sharing enables different service providers to collaborate, creating integrated financial management systems that customers can use conveniently from one place.

These trends – mobile banking, AI chatbots, and open banking – are reshaping the banking experience in remarkable ways. Each trend is marking a significant step towards banking’s digital future, making banking more accessible, personalized, and efficient. These prevailing trends set the scene for what comes next: the future of online banking. Stay tuned for the breakthrough technologies that will amplify these already exciting advancements in our banking experiences.

Breakthrough Technologies in Online Banking

In our digitalized world, breakthrough technologies are creating an unprecedented disruption in the field of online banking. These transformative innovations are the driving forces behind the significant changes we’re witnessing within the industry, not only remolding how financial transactions are conducted but changing users’ banking experience entirely.

On the one hand, we have Artificial Intelligence (AI). AI and its subsets such as machine learning and predictive analytics are playing a pivotal role in online banking innovation. From automating customer service with chatbots to predictive budgeting, and even fraud detection, AI’s potential in banking is boundless.

Blockchain technology, while commonly associated with cryptocurrencies, offers a plethora of applications in online banking. Blockchain brings a revolutionary level of transparency and security to operations, paving the way for solutions such as decentralized banking and seamless cross-border transactions.

Then we have Robots Process Automation (RPA). RPA in banking is making its mark by automating repetitive tasks such as data entry and analysis, account opening or closing, and loan origination. It’s freeing up valuable time for bank employees to focus on more complex and customer-centric tasks.

Biometric technology too is making headway in the banking industry with its potential to offer secure and user-friendly authentication methods. Traditional forms of security are becoming obsolete as biometric technologies— such as fingerprints, facial recognition, and even voice patterns— offer a more personalized and highly secure alternative.

Recently, we have also seen the rise of Internet of Things (IoT) in digital banking. IoT can be used to provide personalized customer experiences by studying customer trends and making recommendations based on those.

These pioneering technologies together are pushing the frontiers of online banking, making it more streamlined, personalized, and secure. As we continue to advance, they will undeniably form the backbone of the next generation of banking experiences. It’s an exciting wave to ride, and the future will, without a doubt, bring even more groundbreaking innovations.

Benefits of Online Banking

In an increasingly digital world, the advantages of online banking are multifaceted and significant. These advantages are the core driving forces in the ongoing shift towards all things digital in the banking sector.

Convenience of Online Banking

One of the most notable benefits of online banking is its sheer convenience. It puts the bank at your fingertips, enabling you to perform financial transactions from anywhere at any time, provided you have an Internet connection. Now, paying bills, transferring funds, checking balances, and even applying for loans can be done conveniently with a few clicks or swipes.

Better Money Management

Online banking can optimize your money management. Up-to-the-minute updates about your account balances and transactions are available at your fingertips. This enables you to make informed financial decisions. Features like:

- Automated recurring payments can ensure your bills are always paid on time

- Built-in budgeting tools can simplify tracking expenditure and savings

Fast and Efficient Banking Options

Online banking also introduces faster and more efficient banking options.

- Electronic fund transfers can now be completed in seconds

- Mobile check deposits eliminate the need to visit the bank physically

Environmental Impact

Online banking plays a role in the green initiative. By reducing the requirement for paper for transactions, it supports a move towards a more sustainable world.

In a nutshell, online banking has not only streamlined our financial management but also baked in an ease and efficiency that’s hard to ignore. As technologies evolve and familiarity with digital platforms among consumers increases, we can expect these benefits to become even more pronounced in the coming years.

Challenges Faced by Online Banking

Online banking, while transformative and convenient, is not without its hitches. The rapid digitalization of banking services poses a set of significant challenges that are being confronted head-on by the industry. One prominent challenge that rears its head is cybersecurity. With the increasing number of online transactions, the risk of fraud and cybercrimes grows proportionately. The banking industry must remain vigilant and proactive in implementing robust security measures to protect sensitive customer data.

Let’s not overlook the digital divide that persists in our societies either. Not everyone has access to high-speed internet or the know-how to navigate these digital banking platforms effectively. This has the potential to exclude a significant portion of potential users, particularly the elderly. Consequently, banks must strive to create user-friendly platforms and offer comprehensive digital literacy programs to ensure inclusivity.

A third challenge is the resistance to change. Often overlooked but equally significant, change aversion can stall the progress of digital banking. Many customers, accustomed to traditional banking, are reluctant to switch to online banking due to concerns about safety, loss of human interaction, or sheer discomfort with new technology. Banks must reassure these customers and build trust in the reliability and convenience of online banking services.

Addressing these challenges will require a blend of innovative thinking, technological advancement, and a customer-centric approach. Overcoming these obstacles is not only crucial for the marathon race of continuous growth but also for the winning dash towards a digitally inclusive financial ecosystem.

Future Trends in Online Banking

As we look ahead, the future of online banking presents a dynamic, nearly sci-fi landscape powered by technology. The shifts we currently perceive are only the tip of the iceberg, with innovative ideas getting hatched every moment that promise to fundamentally change the way we interact with our finances.

Artificial Intelligence (AI) is projected to play a huge role in the next generation of online banking. Picture this – highly personalized, intuitive banking services that understand your financial behavior better than you do. Al-powered bots will not just help with your transactions but can also help manage your budget, advice on investments, alert about potential savings, and even predict future spending patterns.

Next in line is the progressive integration of the Internet of Things (IoT) into banking. From IoT-enabled ATMs to mobile-controlled banking, the networking power of IoT will transform the banking experience to be much more direct, interactive, and user-centered.

Blockchain technology, despite its relatively recent emergence, is set to be a game-changer in online banking. Besides its use in cryptocurrency transactions, blockchain provides an extremely secure platform for all financial transactions. It enables speedy, transparent, and hack-proof transfers – blowing the traditional systems out of the water.

The concept of open banking is another future trend that aims to provide more financial control to consumers. It allows third-party developers to access financial data to build innovative apps and services around banking institutions. This heralds a more interconnected financial ecosystem, bringing previously unimaginable services to consumers’ fingertips.

The online banks of tomorrow are likely to look significantly different from those of today, not in terms of their core business, but the sophistication, convenience, and security they offer to customers. These emerging trends are setting the stage for a high-tech banking industry where customer satisfaction and service personalization hold the keys to success.

The Role of Technology in the Future of Online Banking

As we peer into the crystal ball of online banking’s future, one can’t help but acknowledge that technology will be the nucleus of this evolution. The fine blend of advanced technologies, right from Artificial Intelligence (AI) to IoT (Internet of Things), will drive radical transformations.

AI: The Future of Customer Service and Security in Banking

AI, with its predictive abilities, is set to redefine customer service in banking. Financial institutions are leveraging its potential for personalized services, risk assessment, fraud detection, and investment advice. The prediction for the future sees AI making every transaction a breeze, setting up a personal banker in every pocket.

Machine Learning: Enhancing Decision Making in Banking

Machine Learning (ML), the intelligent cousin of AI, can draw patterns and learn from vast arrays of data, generating smart insights that enhance decision making. ML has strength in predicting customer behaviors and detecting anomalies, aiding in fraud prevention. The future holds great promise for ML in banking, with more advanced predictive systems being developed that could potentially forecast market changes or investment risks accurately.

IoT: Revolutionizing the Concept of ‘On-the-Go’ Banking

Beyond AI and Machine Learning, IoT is another technological force shaping the future of banking. By interconnecting devices and systems, IoT elevates the concept of banking on the go. From wearables allowing payments to smart home devices managing bills, the possibilities are staggering. The interconnection of a multitude of devices promises to make banking ubiquitous, shrinking our world into an interconnected financial ecosystem.

Blockchain: Securing Future Online Transactions

Blockchain technology possesses the potential to revolutionize online transactions. It provides secure, transparent, and decentralized transaction platforms, potentially serving as the antidote to banking fraud. The future could see each individual having a personal ‘bank’ through Blockchain databases.

In essence, technology will not just be the backbone of online banking but its lifeblood as well. The amalgamation of AI, Machine Learning, IoT, and Blockchain promises to deliver an online banking experience beyond convenience, turning it into a custom-tailored, predictive, interconnected, and secure system. The script for the future is loaded with possibilities and innovations, all designed to shift the axis of banking to the realm of high-tech.

Case Studies

When it comes to pioneering future trends and leveraging innovative technologies in the realm of online banking, there are a few standout examples worth exploring.

Firstly, we look at BBVA (Banco Bilbao Vizcaya Argentaria), a Spanish banking giant that has been a global leader in digital banking. Serving as a standard bearer, BBVA has remarkably executed its digital transformation strategy and adopted cutting-edge technologies including AI and Machine Learning. They have introduced “BBVA Valora,” an app that uses big data and AI algorithms to help customers understand the real estate market, a move that exemplifies the application of AI in enhancing customer experience in online banking.

Our second case is DBS Bank, a Singaporean multinational entity renowned for their commitment to innovation. They have created a digibank which offers a mobile-led digital banking platform that takes advantage of AI to offer personalized financial advice to its customers. It operates based on customer input and uses AI to learn and understand customer behavior, offering a precedent of how artificial intelligence can revolutionize user experiences.

Look into the American banking sector, we cannot skip mentioning Ally Bank. Ally bank is a leading player in the online banking landscape with no physical branches. Their robust innovation strategy focused on mobile banking convenience has seen them implement features such as “Ally Assist”, a virtual assistant, which adapts to individual behaviors and preferences, showing how IoT and Machine learning can be utilized effectively.

Lastly, there is Atom bank in the UK, a solely app-driven bank. Atom employs engaging graphic interfaces and biometric security protocols (voice and face recognition) to provide their customers with a dynamic user-oriented experience. Atom bank offers a glimpse into how innovative technologies like AI and biometrics could redefine online banking security and user interface.

From these case studies, the lesson is clear; the future of online banking lies in a convenient, personalized, secure, and tech-driven user experience. Banks at the frontier of harnessing and implementing innovative technologies are most likely to shape the future of the sector.

Conclusion

As we’ve journeyed through the annals of online banking, observed the currents of its ongoing revolution, and peered into the crystal ball of its not-so-distant future, it’s clear that the world of banking is rapidly shifting beneath our feet. The unceasing march of technology treads onward, driving momentous changes in every sector – and banking is certainly no exception.

The industry’s digital transformation has already begun to shape our daily lives in ways that would have been unimaginable a mere decade ago. Real-time money transfers, mobile check deposits, AI-based customer support, and an array of digital financial management tools are no longer the stuff of science fiction – they’re our reality. As AI, Machine Learning, IoT, and Blockchain technologies continue to evolve, they are projected to usher in an era of unprecedented convenience, customization, and security in banking.

The undeniable benefits of this digital transition, however, do not come without challenges. Security concerns, privacy issues, and the persistent issue of the digital divide are obstacles that the industry must resiliently tackle. Nevertheless, with every new challenge we’ve witnessed, relentless innovation emerges to address them, promising an exciting tomorrow for online banking.

This transformative journey has also given birth to a new breed of digital-savvyness in consumers. Today’s tech-forward customers no longer merely expect, but demand, a seamless, personalized, and secure banking experience, driving further innovation in the sector.

In our rapidly digitizing world, change is the only constant. As consumers, it’s in our best interest to embrace these advances with an open mind. As industry insiders, it’s our responsibility to juggle the challenges and opportunities that this transition brings – creating a banking sphere that’s not just more advanced, but also more inclusive, accessible, and customer-centric.

In essence, the future of online banking isn’t a distant thought – it’s already happening. As we step into this thriving era of digitization, let’s not just be passive observers. Instead, let’s dive head-first into the transformative tide, ready to ride the wave of this financial revolution. Are you onboard?